take home pay calculator maryland

Thats the five steps to go through to work your paycheck. Home Maryland Taxes Marylands Money Comptroller of Maryland Media Services Online Services Search.

University Of Maryland University College Stat 200 Stat 200 Final T Brown University Of Maryland Academic Dishonesty Good Grades

Financial Facts About the US.

. Payroll Schedules Salary Scales Forms Contact Information. This allows you to review how federal tax is calculated and maryland state tax is calculated and how those income taxes. Next divide this number from the annual salary.

If your household has. Maryland State Tax Calculation for 90k Salary. Calculate your Maryland net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Maryland paycheck calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Quarterly Estimated Tax Calculator - Tax Year 2022. For a married couple with an annual wage of 160000 in Baltimore City the total take home pay after taxes is 12062877.

The Maryland Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Maryland State. Maryland Salary Paycheck Calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local.

For example if an employee earns 1500. Calculating paychecks and need some help. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Take Home Pay Calculator Maryland. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Maryland. Plus employees also have to take local income taxes into.

Calculates Federal FICA Medicare and. When you make a pre-tax contribution to your. This version of Net Pay Calculator should be used by those who submitted Federal W-4 in 2020 or later.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. This places US on the 4th place out of. Simply enter their federal and state W-4 information as.

This is only an. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Maryland. Maryland State Tax Tables.

This free easy to use payroll calculator will calculate your take home pay. For a single filer with an annual wage of 80000 in Baltimore City the total take home pay after taxes is 5980625. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Tax rates range from 2 to 575. Our Maryland State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 6000000 and go towards tax.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. This net pay calculator can be used for estimating taxes and net pay. You need to do these steps.

Our calculator has recently been updated to include both the latest Federal Tax. You are able to use our Maryland State Tax Calculator to calculate your total tax costs in the tax year 202223. Annual Income for 2022.

Take home pay calculator maryland. Supports hourly salary income and multiple pay frequencies. This Maryland hourly paycheck.

If you have any questions please contact our Collection Section at 410-260-7966. Total annual income Tax liability All deductions Withholdings Your annual paycheck. It can also be used to help fill.

Switch to Maryland hourly calculator. Tax Rate Threshold Tax Due in Band. When you think of Maryland income taxes think progressive.

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. How to calculate annual income.

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Va Income Gu Va Mortgage Loans Mortgage Loan Originator Va Loan

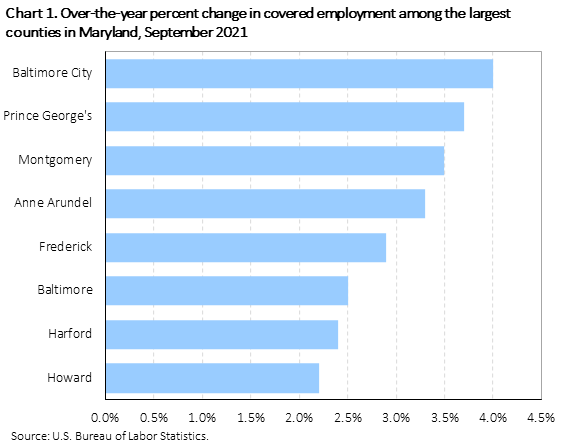

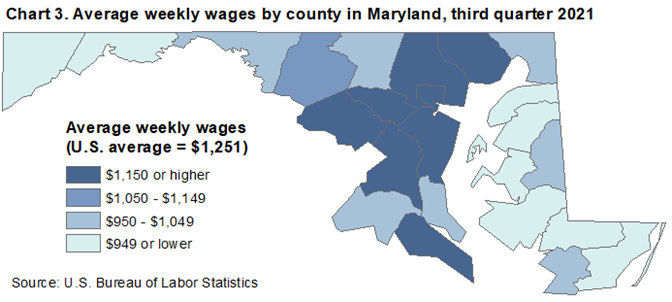

County Employment And Wages In Maryland Third Quarter 2021 Mid Atlantic Information Office U S Bureau Of Labor Statistics

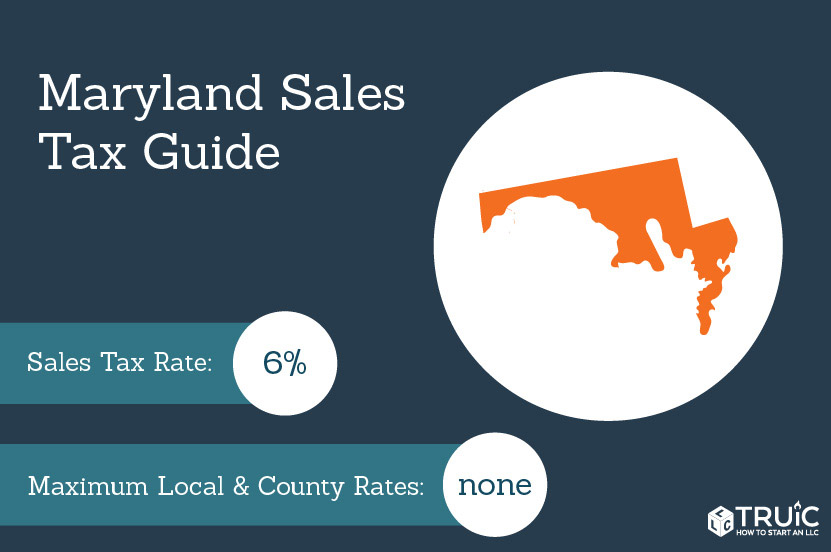

Maryland Sales Tax Guide And Calculator 2022 Taxjar

Free Maryland Payroll Calculator 2022 Md Tax Rates Onpay

Maryland Paycheck Calculator Smartasset

Pin By The Creig Northrop Team Of Lon On Moving Tips From The Creig Northrop Team Maryland Real Estate Real Estate Sales Real Estate Infographic

Mulch Coverage Calculator Mulch Lawn And Landscape Garden Mulch

Maryland Sales Tax Small Business Guide Truic

Tour Spacious Family Homes Near Joint Base Andrews Maryland Joint Base Andrews Military Housing Military Relocation

Should You Pay Discount Points Home Loans Mortgage Mortgage Interest Rates Lowest Mortgage Rates Mortgage Interest

Maryland Retirement Tax Friendliness Smartasset

Maryland Paycheck Calculator Smartasset

Download Simple Child Support Calculator For Wordpress Free Wordpress Plugin Https Downloadwpfree Com Download S Supportive Child Support Daycare Costs

Calculate Child Support Payments Child Support Calculator Proud Maryland Girl Child Custody Cal Cool T Shirts Child Support Quotes Child Support Payments

County Employment And Wages In Maryland Third Quarter 2021 Mid Atlantic Information Office U S Bureau Of Labor Statistics

Maryland Homecredit Program Lender Information

Buy A New Home In Maryland Lutherville Timonium Md 21093 Yp Com Buying A New Home Maryland New Homes